Worldwide Vault Tracking

Worldwide Vault Tracking

Okay, folks, buckle up, because the crypto world in 2025 feels like it’s about to launch into warp speed! Fresh off diving deep into the latest policy reports and market analyses, I'm seeing a convergence of factors that just might redefine the entire landscape. It's not just about the price of Bitcoin anymore; it's about the foundations being laid for a truly decentralized future. We're talking about stablecoin regulation, institutional adoption, and a global race to foster responsible innovation. The pieces are moving, and the picture that's emerging is, frankly, exhilarating.

What's really got my circuits buzzing is the way regulatory clarity is acting as a catalyst. You see, for years, the Wild West nature of crypto has kept many big players on the sidelines. But now, with over 70% of jurisdictions worldwide making headway on stablecoin regulation, that's changing fast. From the US’s GENIUS Act (yes, GENIUS!) to the EU’s MiCA rollout, and new frameworks popping up in Hong Kong, Japan, Singapore, and the UAE, the message is clear: crypto is here to stay, and it's time to play by the rules.

And what happens when the rules are clear? Institutions start moving in. We're already seeing it, right? The TRM Labs report highlights that about 80% of reviewed jurisdictions witnessed financial institutions announcing digital asset initiatives in 2025. Think about that for a second. Eighty percent! That's not a trickle; that's a floodgate opening. It reminds me of the early days of the internet when suddenly every company needed a website. Now, every financial institution needs a digital asset strategy. The Global Crypto Policy Review Outlook 2025/26 Report offers further insights into this trend.

But it's not just about compliance; it's about innovation. The TRM Labs report underscores how compliant intermediaries are becoming essential partners in combating financial crime. It's like the security firms that sprung up alongside the internet boom, protecting the digital frontier. The Beacon Network, an information-sharing platform supported by major VASPs and law enforcement, is a prime example of this collaborative approach. The more secure and transparent the crypto space becomes, the more attractive it will be to both institutions and everyday users.

Of course, there are still challenges. The North Korea hack on Bybit, leading to a loss of over $1.5 billion in Ethereum tokens, serves as a stark reminder of the need for better cross-jurisdictional coordination and real-time information sharing. It's like the early days of aviation when accidents were frequent and regulations were still catching up. We need to learn from these incidents and build a more robust and secure ecosystem. This is where the call for global consistency becomes so vital. As the FATF warns, gaps in standards implementation leave VASPs vulnerable to exploitation. It’s a chain; a chain is only as strong as its weakest link.

The US, under the Trump administration, is clearly making a play to lead the charge. The executive order emphasizing innovation and rejecting a retail CBDC, along with the President’s Working Group on Digital Asset Markets, signals a commitment to fostering a crypto-friendly environment. But it's not just about the US; it's about a global movement. Jurisdictions around the world are experimenting with different approaches, from El Salvador's Bitcoin adoption to Switzerland's DLT trading facility license.

The thing is, this reminds me of the early days of the printing press. Think about it: suddenly, information was decentralized, accessible to anyone who could read. It sparked a revolution in thought, science, and politics. Crypto has the potential to do the same for finance, empowering individuals and creating new economic opportunities. It feels like we're on the cusp of a new era, and I am here for it!

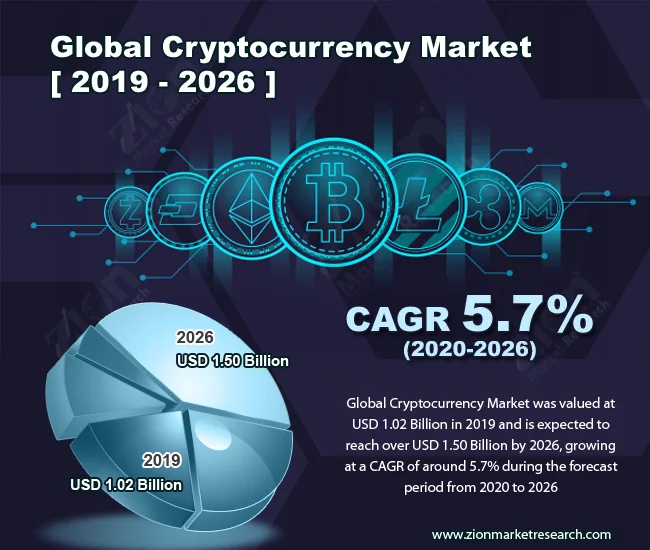

So, where does this leave us? Well, as we approach 2026, the crypto landscape is poised for explosive growth. The key will be balancing innovation with responsible regulation, fostering collaboration between industry and government, and ensuring that the benefits of decentralized finance are accessible to all. We need pioneers, but we also need responsible stewards.